This website uses cookies in order to provide you with the best possible user experience. Cookie information is stored in your browser and performs functions such as recognizing you when you return to the website and helping the team understand which sections of the website you find most interesting and useful.

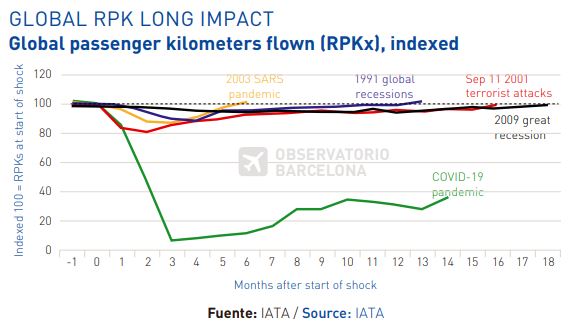

• The effects of the COVID-19 pandemic are proving to be the most severe in the aeronautical industry. 14 months after the start of the pandemic, the global RPK (revenue Passenger per kilometer) stands at -60% of pre-crisis value. Previous crises such as the economic recession of 2009 or the terrorist attacks of September 11 in 2001 presented a much lower reduction, between 5-20% with a recovery period of 6-18 months.

• At a global level, the seats offered as of June 2021 have been reduced by -39% compared to June 2019. The most affected have been the European countries (with reductions greater than -50%), whereas the USA has registered a reduction of only -19% and China has a growth of + 1%, thanks to its large domestic market.

• Nevertheless, and for the first time in Europe since the outbreak of the covid-19 crisis, during the last week of July seat capacity levels exceeded by 50% the capacity corresponding to the equivalent week in 2019, surpassing for the first time in other regions such as the Middle East (48%) or Africa (39%).

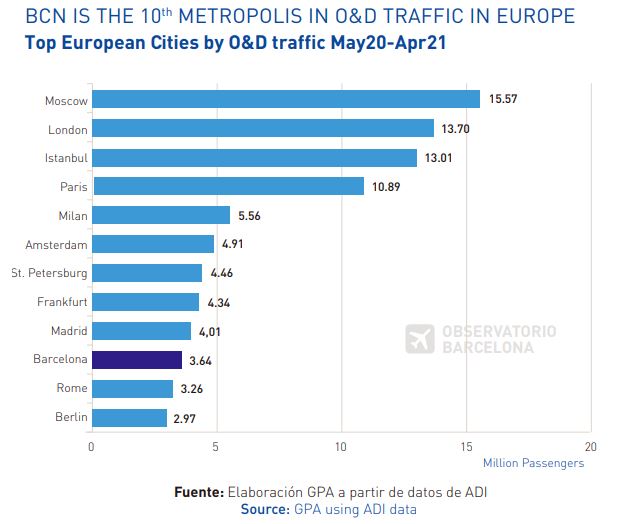

• During the May 2020 – April 2021 period, Barcelona has fallen to the twelfth position at the European level, in the number of passengers (it ranked sixth in 2019) with a decrease in passengers similar to other European airports, -83 %. Connection traffic in this period has been 7% (same as in 2019).

• If we focus on origin-destination traffic at the European level, during the May 2020 – April 2021 period as well, Barcelona is placed in tenth position, above capitals or large European cities such as Rome or Berlin. In 2019 Barcelona ranked fifth behind London, Paris, Moscow, and Istanbul.

• As a consequence of the impact of the COVID-19 pandemic, the Barcelona El Prat J.T. accumulated 12,739,259 passengers at the end of 2020, representing -75% compared to the previous year.

• During the January-May 2021 period, Barcelona has registered a total of 2,455,843 passengers, which represents -87% compared to the same period in 2019.

• Eurocontrol has developed different forecasts for the recovery of the aviation sector at the European level. The short-term European recovery forecast for the year 2021, predicts between 50% and 79% of 2019 operation levels by December 2021, depending on the advance in the level of vaccination in European countries.

• Also according to Eurocontrol, the long-term recovery forecast expects a recovery of operation levels to the ones registered in 2019, between 2024 and 2029.

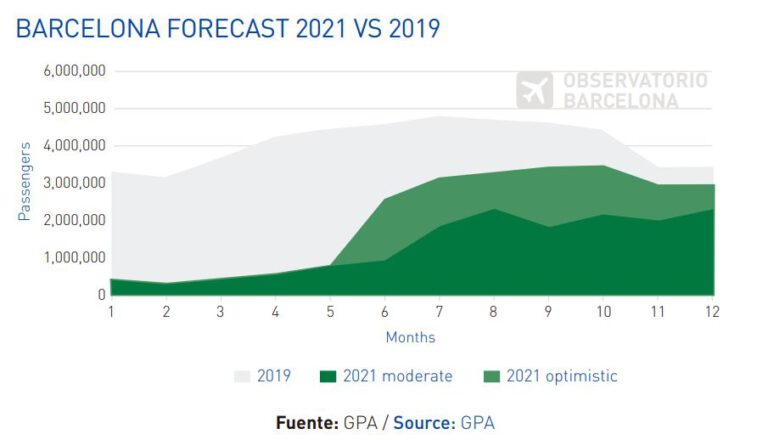

• With regards to the 2021 passenger forecast for the JT Barcelona-El Prat Airport, two scenarios have been defined: the moderate scenario with a reduction of -67% (15.9MPax) and the optimistic scenario with a reduction of -51% (24.1MPax) -percentages and total annual passengers compared to the volume of passengers in 2019. The

the moderate scenario represents a growth of 25% compared to 2020 while the optimistic scenario represents a growth of 90% compared to 2020.

• During the summer season of 2021 Barcelona is expected to have 178 total destinations, which represents a growth of 9% compared to the summer of 2020 and a growth of 60% compared to the winter season of 2021. However, it is still 13 points below the destinations registered during the summer of 2019.

• A great growth in intercontinental routes can be observed, especially in North America, but still far from the levels of 2019. Most of the connections are European routes representing 67% of the total destinations figure, while the domestic market represents 17%. • During the 2021 airline companies are expected to start operating or expand on the following direct routes from Barcelona:

- North America: New York, Mexico City, Cancun, Atlanta*, Boston*, San Francisco,

- Asia and the Middle East: Beirut, Tel Aviv, Seoul*, Amman.

- South America: Santiago de Chile*, Buenos Aires,

- Africa: Tunisia, Oran, Nador

In July 2021, 76 airlines will operate in Barcelona, which represents 86% of the 88 that operated in 2019. Regarding operations, 1,901 departure frequencies have run during the first week of July 2021, which represents 53% of the 3,559 weekly departure frequencies registered during the same week in 2019.

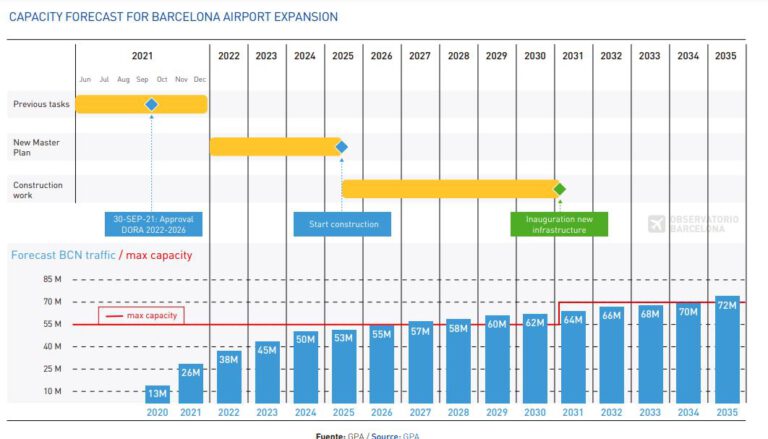

The Barcelona airport has a maximum capacity of 55 M passengers per year, on the basis of its current infrastructure. In 2019, 52.7 M passengers were reached. Given the situation linked to the decrease in traffic during 2020 due to the COVID-19 pandemic, it is expected that the saturation point will be reached in 2026. For this

reason, it is important to undertake a new expansion asap.

• The expansion recently presented by AENA is based on two main actions: The construction of the satellite terminal and the 500m extension of the “sea” runway through the 25L. These actions would allow reaching a maximum capacity of 70M passengers per year and between 80-90 movements per hour.

• Currently the preferred configuration is the one marked in orange in the figure. Take-offs are normally carried out by the “sea” runway (07R-25L), with a turn towards the sea after takeoff to reduce the acoustic impact on Gavà Mar. Except in some situations where the aircraft need more runway length and then it is required to take off from the “land” runway (07L-25R); for example, in summer with a widebody aircraft and maximum weight. These runway change situations reduce the optimal operation of the airport.

• The expansion of the “sea” runway at the 25L would provide a system of two parallel runways with the same length. Allowing an earlier turn towards the sea, it would further reduce the acoustic impact on the Gavà Mar area and Castelldefels.

• The area that would be affected by the expansion of runway 25L corresponds to the Ricarda wetland area, which is a protected natural area of the Natura 2000 Network and also a ZEPA (special bird protection area).

• AENA proposes a series of compensatory measures to expand the protected area by an additional 25%, compensating the affected habitats with new protected areas on the basis of a 1:10 ratio.

• According to the growth predictions Barcelona airport will reach a capacity of 26M passengers in 2021. The maximum capacity level of the current infrastructure is expected to be reached in 2026.

• According to the calendar proposed by AENA, the DORA II (Airport Regulation Document) for the period 2022-2026 should be approved by September 2021. This timing will allow the new master plan to be drawn up and approved during the period 2022-2025, as well as the environmental impact assessment, which will require a favorable evaluation from the European Commission due to the affection of a Natura network protected area.

• If everything goes according to plan, the new satellite terminal and the expansion of the sea runway would be built between 2025 and 2030, increasing the maximum capacity of the airport to 70M pax per year in 2031.

• If this extension is not approved in DORA II and it is necessary to postpone the works until DORA III, the entry into service of the satellite terminal and runway extension would be delayed until 2036.

• In conclusion, it is important to note that the expansion would make it possible to bring the infrastructure to the level of other competing European airports in order to make it attractive for new long-haul connections and Barcelona to be a HUB airport. Barcelona has proved the viability of the low-cost long-haul airline model and currently counts on Vueling as the market leader for connecting and feeding these future long-haul flights. It should be noted that direct long-haul flights are key to the development of air cargo at Barcelona airport.

Source:GPA, Aena, IATA, MIDT

Produced by GPA www.gpa.aero