#43 BARCELONA AIR TRAFFIC INTELLIGENCE UNIT - Report Summer 2022

• Aviation has been one of the sectors that have been most affected by the COVID-19 pandemic. It is still affecting globally, as can be seen in the first graph (global bookings). There was a positive trend in international bookings during February, thanks to the opening of Europe and the United States. However, a decline in the domestic market can be observed mainly due to China’s closure in recent months. In any case, the global trend prospects are positive for the upcoming summer months of 2022.

• As for the second graph (passenger traffic by the airport), Barcelona is in position 9 amongst European airports, moving up two positions in the ranking, concerning the previous observatory. It presents 15% of connection passengers, which is a higher percentage if compared with pre-pandemic levels, but not so relevant in absolute figures. The reduction in traffic compared to 2019 is at a level similar to other main European airports.

• It is noteworthy that Barcelona is the first European airport in origin-destination traffic, with 11 M passengers (April 2021-April 2022 period).

• In the third graph, at the level of European cities with the most origin-destination passengers, Barcelona has risen one position in the ranking (compared to the 2019 observatory), becoming sixth, just above Athens and Madrid. We highlight the leadership of London, as well as the stabilization of Athens in 7th position and Palma de Mallorca in 12th position, cities that entered this ranking in the previous observatory.

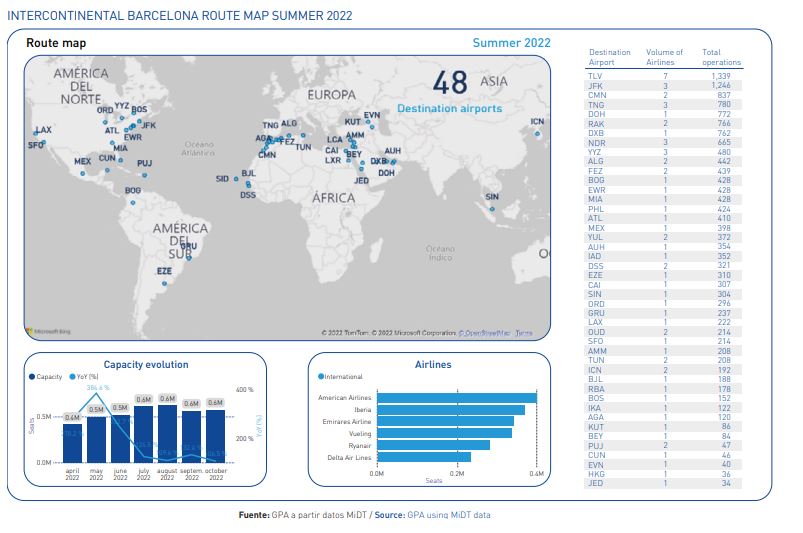

• The map at the bottom of this page shows the intercontinental destinations of Barcelona Airport for this summer season 2022. The table shows the figures for destinations, the number of airlines, and a total number of operations. The number of intercontinental destinations has almost recovered, with 49 destinations in 2019 compared to 48 from this summer season 2022. Although many destinations have only one operating company and fewer frequencies than in 2019.

• The total offer at Barcelona airport for this summer season is 16,907,016 seats, representing only -15% of the total seats offered in 2019.

• In the ranking of destinations for this summer 2022, Barcelona is in ninth position with 198 total destinations, in the same order of magnitude as other European capitals such as Rome and Vienna with 205 and 202 destinations, respectively.

• The connections with the American continent have represented the main recovery for summer 2022, at the intercontinental level. The United States stands out with 533,166 seats (-24% compared to summer 2019) and Canada with 131,687 seats (-15% compared to summer 2019). In terms of destinations, these would be, for the US: Atlanta (Delta), Washington (United), Boston, Los Angeles and San Francisco (Level), Chicago and Philadelphia (American). In the case of Canada: Toronto (Westjet, Air Canada, and Air Transat) and Montreal (Air Canada and Air Transat).

• With regards to new routes, it is worth highlighting the new connections to Riyadh and Jeddah (2 freq/week) operated by Saudia and the new routes to Punta Cana and Cancun (2 and 1 freq/week) operated by Iberojet/Evelop. It is also worth mentioning the recovery of Seoul, operated by Asiana (2 freq/week since July) and Korean (3 freq/week since September).

• Regarding the airlines, Barcelona has almost recovered the 88 airlines it had in the summer of 2019, with 83 this summer of 2022. It is worth highlighting the dominance of Vueling, especially in the domestic and European markets with 70% and 37% of the share, respectively.

• However, the upcoming months are not expected to be easy for European airlines. According to IATA the profitability of European airlines is not expected until 2023.

• The Barcelona JT-El Prat airport has accumulated a total of 13,726,889 passengers until May 2022. This represents a 459% increase compared to 2021, but a reduction of -33% compared to 2019. This reduction is similar to the one registered in Madridbarajas (-26%) but not as good as other airports such as Palma or Malaga (registering only -9% and -12%, respectively).

• Eurocontrol forecasts, updated in June 2022, foresee three possible scenarios for the long-term and short-term scenarios: a recovery of around 90% for summer 2022 and a global recovery by the end of 2024.

• There is variability between countries, but in general, the impact of the war in Ukraine is limited and only affects overflights in several territories such as the Baltic countries and Poland, while there is an increase in flights over the Balkans. In any case, as the Asia-Europe connections have not fully recovered due to the restrictions of the pandemic, the final effect of blocking the overflight of Russian airspace to European airlines cannot be appreciated quite yet.

• Shortly, the lack of personnel in the airport environment must be taken into account as a certain risk. Companies such as Easyjet, British Airways, and Lufthansa (amongst others) have already been compelled to cut their planned offer. In addition, different strikes have also arisen in airlines such as Ryanair and Easyjet, as well as French air traffic controllers.

• The economic uncertainties linked to the growth of inflation and the increase in the cost of travel do not seem to be leading Europeans to change their travel plans: according to the ETC (European Travel Commission), 73% of Europeans plan to make a trip between June and November 2022.

• The European Commission presented, in July 2021, the “Fit for 55” package establishing the roadmap towards the 55% reduction of greenhouse gas emissions by 2030. It represents the trigger of the ambitious regulatory process required to accomplish this aim.

• The three measures concerning aviation are the following: introducing taxes on kerosene, introducing the use of SAF (Sustainable Aviation Fuel), and enforcing emissions trading. The European Emissions Trading Scheme (EU-ETS) establishes a maximum of emissions for the aviation sector, with each airline providing an annual emission report. If the reported emissions are higher than the assigned limit or “cap”, the difference will have to be purchased in the emissions trading market.

• The decision to include all flights taking off from the European Economic Area (EEA) in the emissions trading system (EU ETS) by 2024 has raised criticism from IATA (International Air Transport Association), as it overlaps with other agreements such as CORSIA (Carbon Offsetting and Reduction Scheme for International Aviation), a CO2

compensation and reduction scheme developed by ICAO (International Civil Aviation Organization).

• The graph below shows the initiatives proposed by Eurocontrol to reduce 279 million tons of C02 and thus reach the goal of carbon neutrality in 2050. This objective will be pursued through the following actions:

- 17% increase in aircraft efficiency

- 2% electric and hydrogen aircraft

- 8% operational improvements (ATM)

- 41% use of biofuels (SAF)

- 32% of other measures

Source: GPA, Aena, MIDT, IATA

Produced by GPA www.gpa.aero